The banking industry in Negros Oriental province is presenting a positive forecast with increased deposits and less borrowing this year, a key official from the Bangko Sentral ng Pilipinas (BSP)-Dumaguete branch announced on Tuesday.

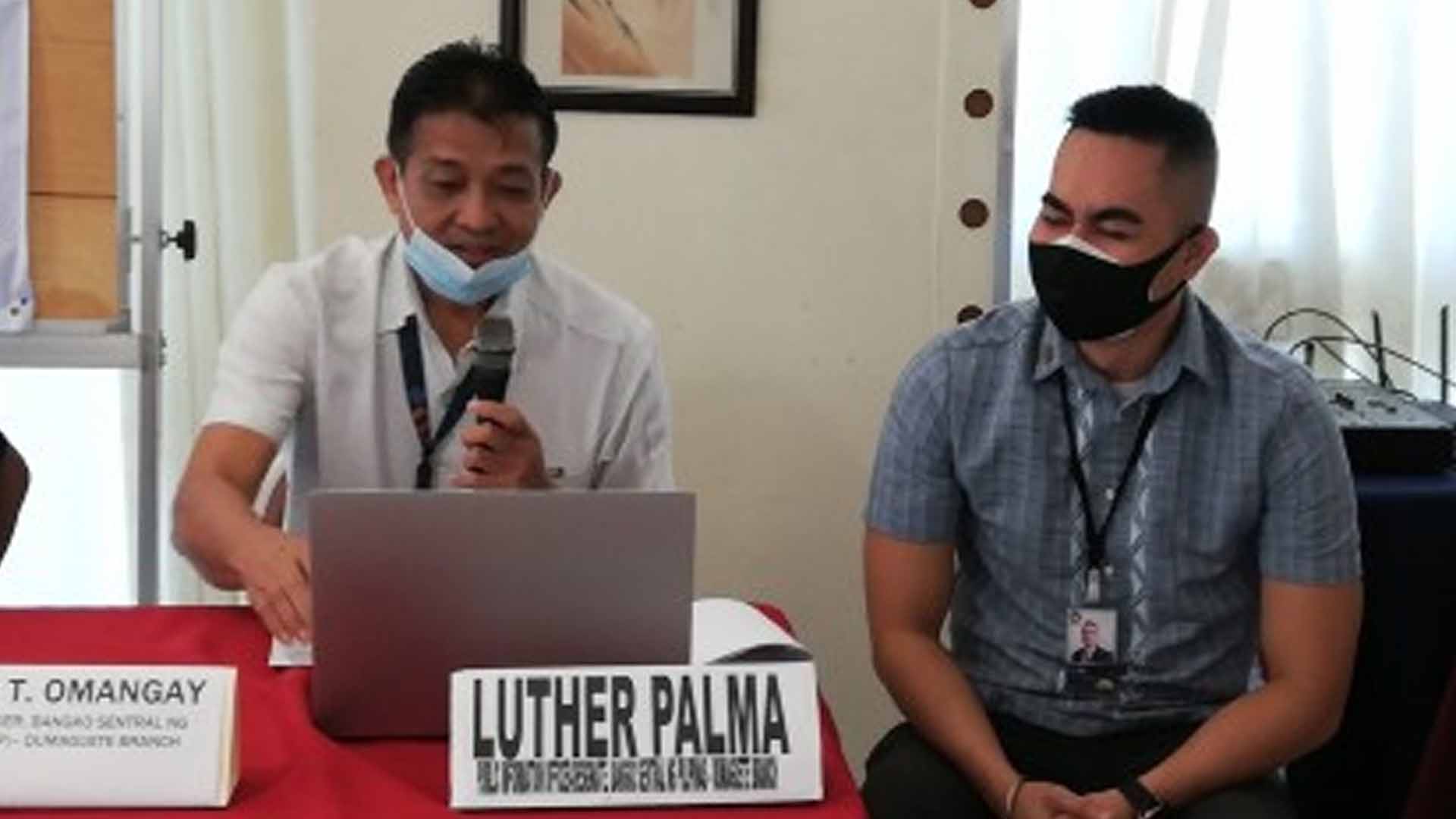

Danilo Omangay, acting branch manager of BSP-Dumaguete, in a Kapihan sa PIA forum at a local hotel here, said the total deposit liabilities in Negros Oriental as of March 31, 2022 are at more than PHP76.4 billion.

This increased from last year’s figures of more than PHP68.4 billion, he noted.

Total deposit liabilities refer to the total amount of deposits held by financial institutions (from depositors). It is the sum of savings deposit, demand deposit, time certificates of deposit, long-term negotiable certificates of deposit, and negotiable order of withdrawal (NOW) accounts, according to the BSP website.

Omangay said the increase in total deposit liabilities means that many people are “saving or depositing money in the banks so that the banking industry in Dumaguete (and Negros Oriental) is booming,” he said in mixed English and Cebuano.

In the banking network, he said Negros Oriental already has a total of 125 banks compared to only 121 last year.

These include commercial and universal, thrift, rural, and corporate banks.

Omangay said the increase in the number of banks shows that more people are also doing transactions with these financial institutions.

The number of ATMs (automated teller machines) as of March this year reached 176 from 162 last year.

On the loan portfolio of Negros Oriental, records at the BSP-Dumaguete show a decrease of about PHP1 billion as of March 22 this year, or some PHP10.4 billion compared to more than PHP11.8 billion last year, Omangay said.

“So nag decrease ang mangulutang, nisaka ang nag deposit or nag save (So the borrowers have decreased while more have deposited or saved),” Omangay said.

Luther Palma, acting information officer of BSP-Dumaguete, said the decrease in borrowing and rise in savings or deposits for private individuals and private entities could mean that people here are smart in managing their finances, especially in the midst of the current inflation in the country.

Palma said business is slow because “you use credit for business” but on a positive note, he thinks that people here are not “kuripot” (stingy) but rather cautious in borrowing money given the current inflation.

“I think that if that is the culture of the people here, that could spell progress also for the people of Dumaguete and the numbers also show it,” he added. (PNA)